💥 Israel Attacks Iran: Oil Soars, Markets Crash – What You Must Know Today!

Date: June 13, 2025

In a shocking move, Israel launched powerful airstrikes on Iran’s nuclear and military sites. This sudden action has shaken the global economy, triggering massive changes across oil, gold, crypto, and stock markets.

📉 Global Market Reaction

- Oil Prices jumped by 10%, reaching the highest levels in 3 years.

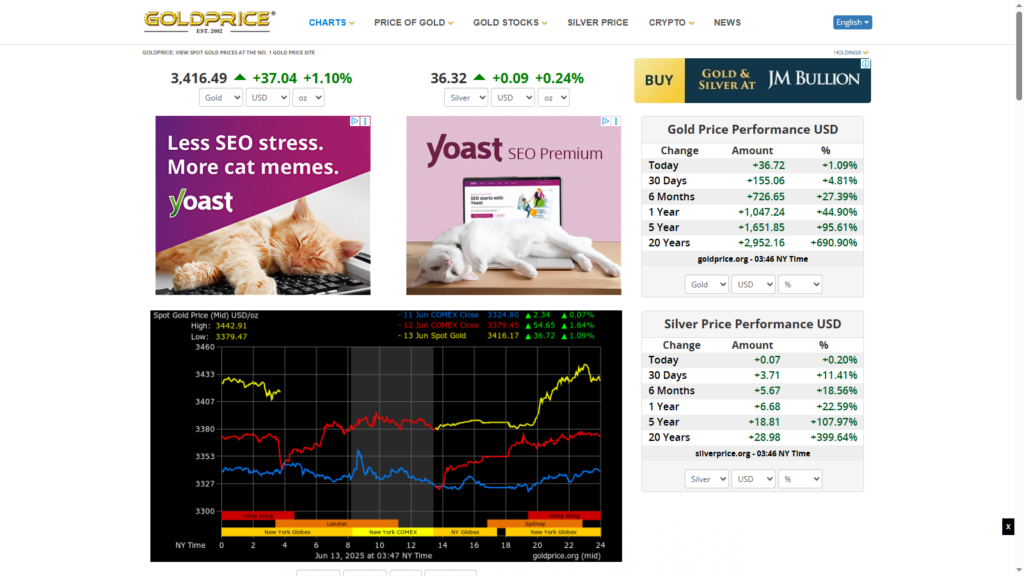

- Gold rose as investors rushed to safe assets.

- US Stock Futures (Dow, Nasdaq, S&P 500) fell by 1.5–2%.

- Bitcoin and other cryptocurrencies crashed, with BTC falling below $103,000.

- Asian & European Markets opened red, showing panic selling.

🔍 Why Did This Happen?

Israel claims the attack was a pre-emptive strike to prevent Iran from advancing its nuclear and missile programs. This news spread fear among investors, who quickly moved their money out of risky investments.

Experts say the rising tension in the Middle East always affects oil prices and pushes traders towards gold and safe currencies like the Japanese Yen and Swiss Franc.

🛡️ What Should Investors Do?

- Avoid risky trades for now.

- Invest in gold or stable assets until markets settle.

- Watch oil and energy stocks – they may benefit in the short term.

- Stay updated on geopolitical news – further escalation could crash markets more.

📅 What’s Next?

If Iran retaliates, expect more market volatility. The Strait of Hormuz (where 20% of global oil passes) could be affected, causing even higher oil prices and supply issues.

Investors around the world are waiting for statements from the US, OPEC, and central banks.

yeah thats right